The balance of payments on current account

The balance of payments is a measure of a country's interatons with the world. It can be split into the balance of payments on current account and on capital account. The capital account refers to the amount of foreign

investment in a country but is not covered at GCSE level.

The balance of payments on current account is the difference in trade between goods and services imported and exported as well as the balnce of income flows and transfers. Imports and exports make up the bulk of this figure.

Income flows is where foreign investors are earning interest on UK investments or UK investors are earning interest on forign investments. Transfers takes into account things like foreign aid and the money foreign natonals

working in the UK might send back to people overseas.

When there are more exports and money coming in to the UK than imports and money going out of the UK then there is a surplus on the balance of payments on current account. When imports and money going out is higher we have a

deficit on the balance of payments on current account. If they matched it would be balanced.

Analyse recent and historical data on exports and imports

Once again this will require you to describe the trends you see and use your knowledge of the effects of having a surplus or deficit on current account on either producers or consumers.

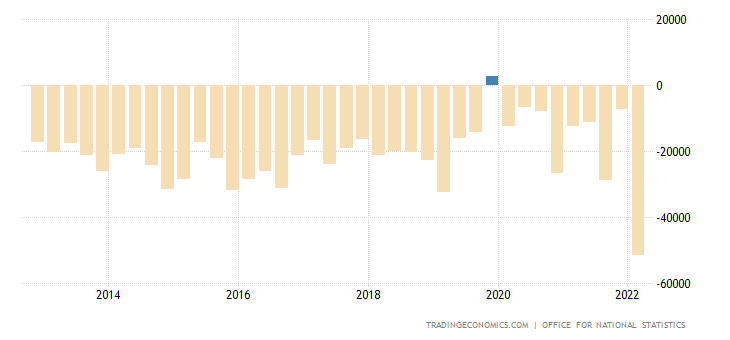

For the UK as seen below we could say that at the start of the period the UK had a deficit balance of payments of just below £20bn. It stayed fairly consistent either side of £20bn. Recently there were several years with lower

deficits and one small surplus but the final quarter is the worst balance of payments on current account in the period by far at over £50bn. You would go on to talk about the effect on demand and jobs for instance. It depends

how the question is worded.

UK current account - courtesy Trading Economics - ONS

UK current account - courtesy Trading Economics - ONS

Evaluate the importance of the balance of payments on current account

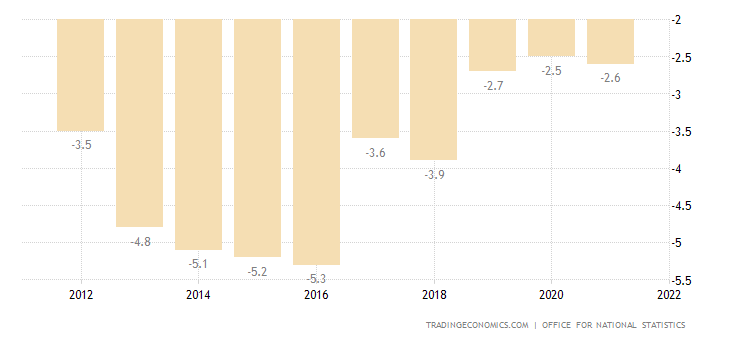

The figures above may seem extremely concerning. The UK has only had one year with a surplus. Should we be worried about an ongoing deficit? Certainly the length of the UK's deficit is of some concern but it is also important

to give it some perspective. To do this we look at the deficit as a percentage of GDP. When we look at the UK debt as a percentage of GDP it is far less concerning. However, that does not mean there are no concerns for the UK.

Worker productivity has long been an issue with UK productivity often lagging behind some of it closest trading partners.

UK current account to GDP ratio - courtesy Trading Economics - ONS

UK current account to GDP ratio - courtesy Trading Economics - ONS

In general a deficit represents lower demand for domestic products which could have knock on effects on employment and start a downward cycle. It also means that the extra spending on imports is not fully funded by income

from exports so debt is increasing.

So what about a current account surplus? That must be all great right? It will help to increase total demand which may mean more workers are needed and the whole positive growth spiral that brings with it. Also debt is now

decreasing as we earn more than we buy. However the increased demand can cause inflationary pressure on prices. A sustained current account surplus means that more of our currency will be needed to be bought to cover the extra

amount and this inreased demand can lead to an increase in the exchange rate. If the surplus on current acount is because of prtectionist policies like high tarrifs and quotas on imports then it may be masking deficiencies

within the domestic market.

Exam style questions

Use the space below each question or a pen and paper to write your answer. When complete click the button for the answer and mark scheme.

NOTE: Answers typed into the browser will not be retained if you leave the page or refresh

Questions

Explain what the balance of payments on current account is. (2 marks)

The record of imports and exports(1) income flows and transfers between one country and the rest of the world.(1)

Explain what is meant by income flows. (2 marks)

Money that foreign investors earn on their investments in the UK(1) and money that UK investors earn on their investments abroad.(1)

Explain what is meant by transfers. (2 marks)

It covers money given freely such as foreign aid and money foreign nationals in the UK send home to their families(1) and money UK nationals living abroad may send back to the UK.(1)

Explain what is meant by a deficit on trade. (2 marks)

Imports(1) are greater than exports.(1)

Case study/Scenario

The UK has a long history of balance of payment on current account deficits. Evaluate the importance to the UK economy of a persistent balance of payments deficit. (6 marks)

Sample answer:

When you have a balance of payments deficit it increases debt{AO2} beacuse the additional spending on imports is not funded by additional income from within the country.{AO3a} If levels of debt in the country

rise then people have less to spend affecting domestic demand.{AO3a}

On the other hand the UK balance of payments on current account deficit is only a small fraction of GDP{AO3b} so will have a limited effect on total

debt.{A03b}

Although the balance of payments deficit is not ideal for the UK the fact that it is only a small percentage of GDP means it is not particularly important.{AO3b}

<< Previous: Importance of international trade Next: Exchange rates >>