Price stability and inflation

Price stability refers to how quickly the general level of prices rise. A rise in the general level of prices over time is known as inflation. When prices rise you cannot buy as much with the same amount of money. This

gives rise to the idea of real and nominal values. Real values take account of the effects of inflation.

|

Nominal value |

Real value |

| Income |

Your nominal income is the actual amount of money earned for the year. It is very rare for nominal incomes to fall. It is much more common for people to receive a small regular increase to their nominal income. |

Your real income takes account of inflation. It represents the purchasing power of your new income. If a person receives a pay raise of 3% but inflation is 5% they have actually had a 2% reduction in real wages. |

| Interest |

Nominal interest is the actual rate of interest being offered. |

The real rate of interest takes into account the effect of inflation. If you have interest of 4% but inflation is at 3% then the real rate of interest is actually 1%. |

The consumer price index(CPI)

The consumer price index is what we use in the UK to measure inflation. We calculate it by looking at movements in the price of the 'basket of goods'.

The basket of goods refers to a list of goods that is supposed to be representative of what an average family might spend their money on. The list is weighted to include certain amounts of items from certain sectors. For

instance, the highest share of the basket is made up of food and non-alcoholic beverages which make up 24% of all products measured. Recreation and culture products make up 17%, clothing and footwear 12% etc. While the percentages

rarely change the actual items in the basket of goods are always being modified to be more reflective of changes in purchasing habits. In 2021 some of the items added included electric cars, hand hygiene gel and men’s loungewear

bottoms. Some of the items removed included doughnuts, coal and laminate flooring.

Importantly, the prices of items in the basket of goods are measured each month at a wide range of stores from big retailers to small independent stores, in big cities and smaller towns and villages. This helps to give a

more even view of the experience of more people.

Calculate the effect of inflation on prices

To calculate CPI we start each year with a base value of 100 for the value of all the items in the basket of goods. Their changes are tracked over the year. A final CPI value of 103 would mean that we had paid 103% of the original

price of the basket of goods at the end of the year meaning a 3% increase.

Simple calculation question here.

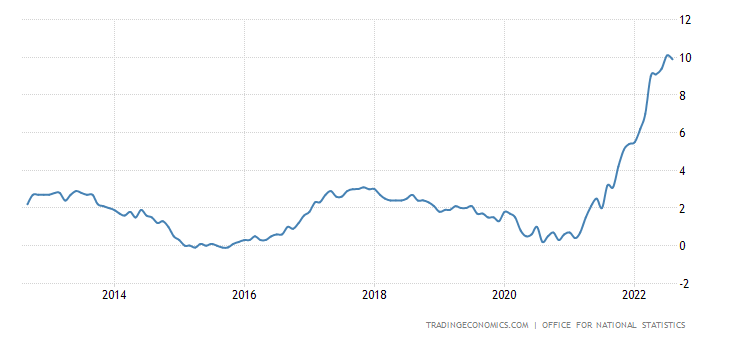

Analyse recent and historical inflation figures

Once again Trading Economics is the best place to go for inflation data. After selecting your country the inflation data is under the prices tab.

Once again this will require you to succinctly summarise the data and then apply your understanding of the effects of that level of inflation. We will discuss these in the next section in detail. A fair description of this

data might be:

Inflation in the UK started the period about 2% and slowly fluctuated between 0 and 3% until 2021 when it rose sharply to the current level near 10%. You would then go on to talk about the effects of inflation early in the

period compared to at the end.

UK Inflation rate courtesy: Trading Economics - ONS

UK Inflation rate courtesy: Trading Economics - ONS

Evaluate the causes of inflation and their consequences

The causes of inflation

There are two main types of inflation: demand-pull inflation and cost-push inflation.

| Type of inflation |

Graph |

Description |

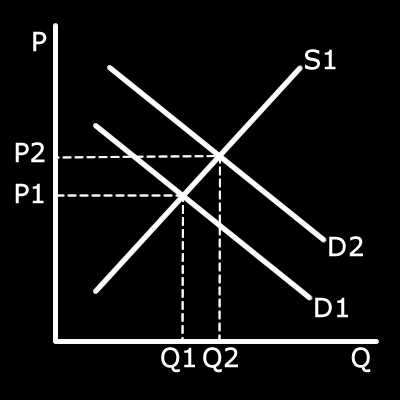

| Demand-pull inflation |

|

This happens when there is high demand in the economy, but this on its own is not enough to cause demand-pull inflation. If higher demand is matched by increased supply the market will stay in balance, but if supply is

unable to keep up with demand then we will see demand pull inflation.

This is more likely to happen when the economy is strong and near full employment so it is hard to get the resources to increase supply. During the

pandemic the government injected £895bn into the economy through quantitative easing. This is where the Bank of England increase the money supply by purchasing government bonds, thus introducing new money. This is

considered an extreme measure and only used in the event of major issues like the pandemic. If the money supply is increased then it can lead to increased demand which if not matched by supply can be inflationary. |

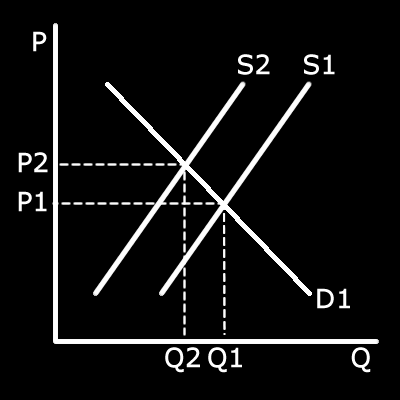

| Cost-push inflation |

|

This is where the costs of production go up. This means firms are less willing to supply at each price, leading to a left shift of supply. This leads to higher prices and lower levels of sales.

Costs can go up because

of the price of raw inputs increasing or the price of business expenses like rent and power increasing. For most firms wages represent their largest expense. The relationship between wages and inflation can lead to something

called the wage-price spiral.

The wage-price spiral works like this: There is a rise in inflation. Therefore workers request a rise in pay to cover additional costs. However by giving this rise, it raises costs for firms.

These firms respond by increasing prices. This creates further inflation. As can be seen the wage-price spiral can be a vicious circle creating more and more inflation.

This raises the tension between producers who want to

keep costs down and workers and their representatives like trade unions who want to maintain real wages and living standards. |

The consequences for consumers

| Consequence |

Explanation |

| Consumer confidence |

Individuals tend to use budgets in order to achieve their goals. When prices are constantly in flux people are uncertain about how much money they will need for the things they want in the future. This

uncertainty leads people to save rather than spend. |

| Falling real incomes |

As we have seen if wage increases are lower than inflation then people are facing a real terms loss of income. |

| Increasing gap between rich and poor |

When inflation is high some groups with better unions and where supply of labour is less elastic may be able to negotiate strong raises to negate the effect of inflation while low paid groups and those on benefits may

receive far lower raises and face significant real income loss. |

| Shoe leather costs |

This is an old fashioned term from when people would need to go from place to place trying to find out who had the best price and in the process wearing out their shoes. When prices are high shoppers will want to make

sure they are getting the best value for money as they can. Looking around for the best deals takes time whether by visiting stores, making phone calls or going online. |

| Debtors benefit |

Individuals and firms that have loans will eventually have to pay those loans back. When we have inflation the real value of that principal they have to pay back is lower and so they benefit. |

| Savers lose |

People with a lot of money in savings will find that in times of inflation the real value of their savings is decreasing. This can have a big effect on people like pensioners who have a fixed amount of savings. |

The consequences for the producers

| Consequence |

Explanation |

| Producer confidence |

Just like individuals, when firms are faced with high inflation they are uncertain about how much money they will need in the future. It also makes them uncertain about the demand they will have in the future. Therefore

firms are less likely to invest and expand when inflation is high. Producers of big ticket items may suffer the most as these are the sorts of things people may delay their purchases of when inflation is high. |

| Menu costs |

If prices are regularly changing then these need to be updated. Menu costs does not refer only to restaurants having to print new menus with new prices but to all costs from changing prices. This could be changing

details on websites or having to have a staff member use their time to go round a shop setting new prices for certain barcodes. |

| Industrial conflict |

When inflation is low it is easier for firms to get away with small increases but as inflation increases there is a wider gap between firms who want to pay just below inflation raises and workers and their unions who

will want to be compensated for inflation and if it is expected to go on for some of that expected coming inflation. This leads to more conflict that can mean increased industrial action such as strikes. |

| Creditors lose |

Many firms offer their product on what is known as credit terms with it very common in a lot of industries for payments to be received 30 days or more after the sale. Firms that have creditors during inflation are losing

because the real value of the money they are owed is going down. |

The consequences for the government

| Consequence |

Explanation |

| Gains as a debtor |

The government has a lot of outstanding debt which as previously explained the principal of this debt is decreasing in real terms. |

| More tax revenue |

Because the government receives VAT as a proportion of sales, if the price of goods increases then so to does the actual amount of VAT collected. |

| Higher public sector costs |

The public sector refers to all the people employed by the government and this is a lot of people. In times of inflation public sector workers will want higher pay rises. This is till really dependent on the government

and in the UK public sector pay has seen real terms cuts for many years. |

| Higher costs for benefits |

High inflation depresses demand and causes unemployment. People that are unemployed both pay no income tax reducing government income but also receive benefits increasing government expenditure. |

| Instability and low growth |

If inflation is high then firms and consumers lack confidence and this limits the possibilities for growth. For this reason the government has a policy to try to promote low levels of inflation. Because some inflation

allows firms greater flexibility to increase prices the government does not aim for zero inflation but rather a low rate of 2% with a 1% margin of error i.e. if inflation is between 1 and 3% then there is no need for intervention. |

Exam style questions

Use the space below each question or a pen and paper to write your answer. When complete click the button for the answer and mark scheme.

NOTE: Answers typed into the browser will not be retained if you leave the page or refresh

Questions

Explain what is meant by the cost of living. (2 marks)

The price level(1) of the goods and services bought by an average household.(1)

Define inflation. (2 marks)

A sustained rise in the general level of prices(1) over time.(1)

Explain the difference between real and nominal interest on savings. (2 marks)

Nominal interest on savings is the percentage interest that you receive on your savings(1) whereas the real rate of interest would also take into account inflation.(1)

Explain how the consumer price index works. (2 marks)

It creates an index by tracking the changes in price of a basket of goods an average family might buy(1) over the course of a year.(1)

Case study/Scenario

Inflation in the UK is currently at 10%(Nov 2022) one of the highest levels it has been at for a long time.

Evaluate the consequences of these high rates for individuals in the UK. (6 marks)

Sample answer:

If workers do not agree a pay rise of above inflation then their real wages fall.{AO2} This means that they will not be able to buy as many goods and services leading to a lower standard of living.{AO3a}

Some higher skilled workers that have higher demand for their services will be in a better position to negotiate an above inflation pay rise while low paid workers will likely receive below inflation pay

rises.{AO3b}

Consumers who have mortgages gain because the real value of their debt is decreasing while the value of their asset is increasing.{AO3a} Naturally, this only affects those individuals that have a mortgage

and even they would only see the benefit in the future if they sell their home.{AO3b}.

For a majority of workers high inflation like this will result in a fall in real wages and decrease in standard of living but for

those lucky enough to get a pay increase above inflation it is not important. People may gain as mortgage holders but in the short term they would still mostly have a fall in real wages and for some this may make mortgage

payments harder to meet.{A03b}

Evaluate the consequences of these high rates for the UK Government. (6 marks)

Sample answer:

In the long term high rates of inflation are extremely damaging to the economy because of the wage price spiral that occurs,{AO2} meaning the government really needs to apply policies aimed at curbing

inflation{AO3a}. This might not be a problem if it followed their plans anyway but many inflation cutting plans are unpopular with voters so it depends how they take it.{AO3b}.

In the short term the Government will receive

more in VAT because it is levied as a proportion of the price which is higher due to inflation{AO3a}. However, benefit payments are generally inflation linked and so the Government will pay more for benefits.{AO3b}

Inflation at such high levels has very high consequences for a government and the deciding factor on how severe these consequnces will be is how long it takes to get inflaton under control.{AO3b}

<< Previous: Fair distribution of incomes Next: Fiscal policy >>